Outstanding expenses are those expenses which have been incurred during the current accounting period and are due to be paid however the payment is not made. Incurred expenses refer to fees that have been charged to a business but have not yet been paid by the company Since these charges will be paid in the future theyre also considered accrued expenses until they are paid off.

Solved Costs That Are Expensed When Incurred Are Called Chegg Com

Incurred cost in accrual accounting refers to the expense of the company when an asset is consumed and the company becomes liable for and may include direct indirect production operating expenses that are incurred for running the business operations of.

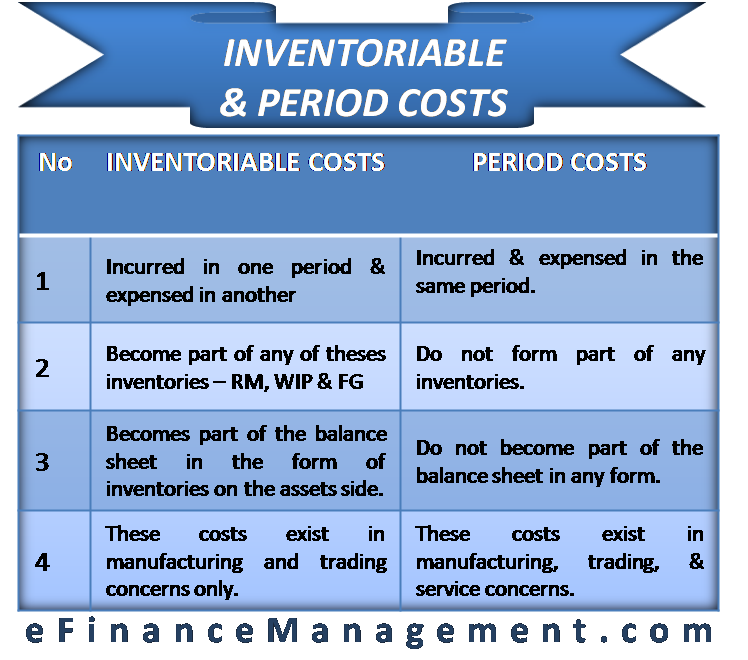

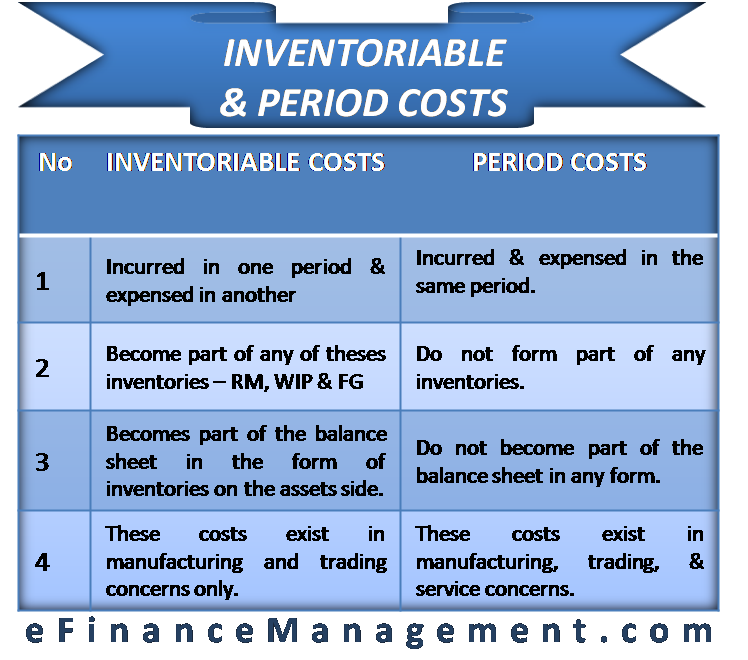

. Costs that are expensed when incurred are called. Inventoriable costs are not expensed when incurred. 1 Costs that are expensed when incurred are called.

Accounting questions and answers. For immaterial expenses such as office supplies an expense is assumed to have been incurred as soon as these items are purchased since it is too expensive to keep track of them and record when the items are actually consumed on a later date. Common prepaid expenses may include monthly rent or insurance payments that an expense that has been incurred but not yet paid is called have been paid in advance.

Costs that are expensed when incurred are called. Examples Outstanding salary outstanding rent outstanding subscription outstanding wages etc. Costs that are expensed when incurred are called.

In other words its when a company uses an asset or becomes liable for the use of an asset in the production of a product. This means that these costs will only. The correct answer is.

You do not necessarily incur an expense when you incur an obligation. Till the payment for goods and after the payment is made the expense is called as paid expenses or discharged expenses. Tap again to see term.

Types of Incurred Cost. Resources such as equipment and utilities consumed in the process of manufacturing a product are called. Product costs are not expensed when incurred.

The expenses incurred on the setting up of the enterprise are called as _____. Different Types is explained as under. Any time a business makes a purchase but has not paid for it yet is an incurred expense.

Costs that are expensed when incurred are called. Cost concept direct costs period costs product costs indirect costs. Direct costs are not expensed when incurred.

Click card to see definition. An incurred expense is a cost that a business incurs when it purchases goods or services on credit. Click again to see term.

Deferred expenses also called prepaid expenses or accrued expenses refer to expenses that have been paid but not yet incurred by the business. The purchase may be made either through a credit card Credit Card A credit card is a simple yet no-ordinary card that allows the owner to make purchases without bringing out any amount of cash. -Period costs are expensed when incurred - Product costs are also called inventoriable costs-Inventoriable costs are expensed in the period in which they are incurred - All costs in a merchandising company are period costs.

Such an item is to be treated as a payable for the business. These assets cease to be a resource and are converted into an expense. Expenses incurred but not yet paid or recorded are called prepaid expenses.

The goods received and payment due becomes the incurred expenses till 10042019 ie. Th total manufacturing cost includes the cost to make the product including the direct materials cost direct labor cost and manufacturing overheads. Solved Costs that are expensed when incurred are called.

Tap card to see definition. The payment for the goods is due on 10042019 ie. When recording an accrual the debit of the journal entry is.

Costs that are expensed when incurred are called. Costs that are expensed when incurred are called. See full answer below.

The period is an important term used in cost accounting. An incurred cost in accrual accounting is the moment in time when a resource or asset is consumed and an expense is recorded. Period costs are costs that are considered as expense when incurred.

Costs that are expensed when incurred are called. 2 Which of the following entities would most likely have raw materials work in process and finished goods.

Inventoriable And Period Costs Definition With Example And Differences

Solved 5 Costs That Are Expensed When Incurred Are Called Chegg Com

Period Costs For A Manufacturing Company Would Flow Directly To In 2022 Cost Of Goods Sold Income Statement Period

0 Comments